Starting from January 1, 2024, the European Union’s Emissions Trading System (EU ETS) will be expanded to cover emissions derived from the shipping industry within EU jurisdiction. This means transporting products within, or in and out of the EU will incur additional costs. Ocean carriers will purchase allowances based on greenhouse gas emissions emitted by burning fuel for the voyage and will in most cases, pass on this cost to their customers.

EU ETS will cover shipping activities within the European Economic Area (EEA). The regulation will be implemented in a phased approach during the coming three years. In 2024, ship operators must purchase allowances for 40% of all emissions.

• In 2025, ship operators must purchase allowances for 70% of all emissions.

• In 2026, ship operators must purchase allowances for 100% of all emissions.

Which trips will be affected?

Starting in 2024, all voyages within, and voyages coming into and out of the EEA will be impacted by an additional surcharge based on the vessel’s fuel emissions. What’s counted:

• 100% of emissions derived from ships docking at an EU port

• 100% of emissions derived from voyages between EU ports

• 50% of emissions derived from ship voyages departing from an EU port to a non-EU port

• 50% of emissions derived from ship voyages departing from a non-EU port to an EU port

An example to better understand EU ETS

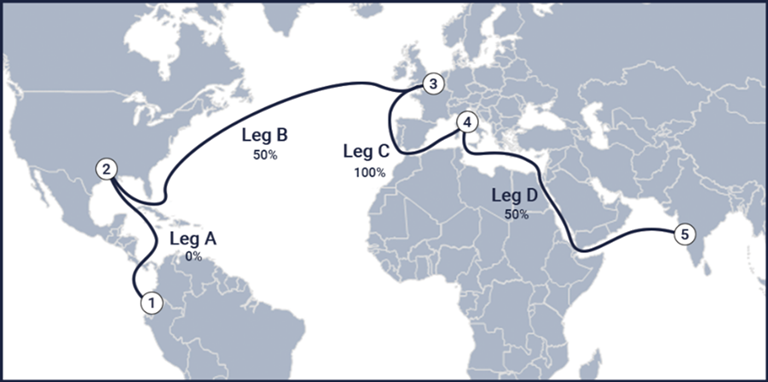

In this example, a ship operator begins its’ journey in South America and ends in Asia and transits via North American and European ports. Below indicates where EU ETS would be applicable for sea leg emissions and port call emissions.

Sea leg emissions

• Leg A is not subject to EU ETS as it does not begin or end in European waters.

• Leg B is subject to a 50% taxation factor as it ends in Europe.

• Leg C is subject to a 100% taxation factor as it begins and ends in Europe.

• Leg D is subject to a 50% taxation factor as it begins in Europe.

Port call emissions

• Ports 1, 2, and 5 are not subject to EU ETS as they are not in Europe.

• Ports 3 and 4 are subject to a 100% taxation factor for emissions produced while in port.

How big will the impact be?

The carbon price is based on the price of EU Allowances and the scope of coverage. As the EU Allowances are based on a cap-and-trade system, the prices are subject to change. Depending on the shipping company, their vessel setup, and their sailing schedules, the EU ETS amount can differ, even on the same route. Several carriers have already given indications of the expected cost impact per tank container, as indicated in the table below for two example trades.

EU ETS and Stolt Tank Containers

At Stolt Tank Containers, we have decided not to pass the EU ETS costs to customers by issuing a separate invoice or charge. Instead, the EU ETS charge will be built into our pricing, making it easier for our customers to process invoices and ensuring we stay as competitive as possible in this market.

We will keep a close eye on further EU ETS developments and will update customers on further developments.

Sustainability at Stolt Tank Containers

At Stolt Tank Containers, we’re market leaders in transporting chemical and food-grade products and we’re here to help optimize your supply chain, minimise costs, and increase efficiency in your liquid logistics. We’re committed to reducing our own greenhouse gas emissions and we’re here to help you reduce your greenhouse gas emissions from transport. This includes incorporating more sustainable fuels and modes of transport and working with you on specific projects to help you reduce your carbon footprint.

We’re committed to moving towards a sustainable future in our offerings, depot operations and services. You can also read more about sustainability at Stolt Tank Containers here.

Learn more about the EU ETS

The EU ETS is one of several cornerstones of EU¬¬¬¬ climate policy to reduce greenhouse gas emissions via a cap-and-trade system and carbon pricing. Under the ‘polluter pays’ principle, polluters are held accountable for the pollution they create to generate an incentive to reduce their environmental damage. The inclusion of the maritime sector emissions was recently adopted under the ‘Fit for 55’ banner.

Read an FAQ from the EU on maritime transport in ETS here: https://climate.ec.europa.eu/eu-action/transport/reducing-emissions-shipping-sector/faq-maritime-transport-eu-emissions-trading-system-ets_en

You can learn more about the EU ETS from the European Commission: https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets/what-eu-ets_en

You can read the specific EU Directive to include maritime sector transport here: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv:OJ.L_.2023.130.01.0134.01.ENG

Learn more about Stolt Tank Containers' ISO tank containers